federal tax abatement meaning

The purpose of tax abatement programs is to attract home buyers and business owners to locations with low demand such as areas in the midst of urban. Tax Abatement Meaning Software Income Tax Calculator v15 This Income Tax Calculator shows current and past tax brackets and estimates federal tax for years 2000-2012.

Dt Max Schedule 8 Capital Cost Allowance Cca

Tax Abatement Definition Tax abatement defined as the decreasing of the tax responsibility of a firm by government is one of the tools which government uses to motivate.

. IRS Definition of IRS Penalty Abatement. This can help site. Chapter 100 Tax Abatement definition.

How Do Tax Abatements Work. You may qualify for relief from penalties if you made an effort to comply with the requirements of the law but were unable to meet your tax obligations. The federal tax abatement reduces Part I tax payable.

A tax abatement is a property tax incentive government entities issue that will reduce or eliminate taxes on real estate in a specific area. The federal tax abatement is equal to 10 of taxable income earned in the year in a Canadian province or territory. Chapter 100 Tax Abatement means tax abatement on real andor personal property granted by.

Line 608 Federal tax abatement. In most jurisdictions there are multiple. Property tax abatement is a decrease in the amount of money owed to a governmental tax authority on a real property tax bill.

Tax abatements are incentives granted by the government to reduce the amount of tax paid by individuals and businesses on assets like properties. Your property tax bill will be lower or. In broad terms an abatement is any reduction of an individual or corporations tax liability.

The term commonly refers to tax incentives that. The federal tax abatement is equal to 10 of taxable income earned in the year in a Canadian province or territory. Taking advantage of federal state and local tax incentives and credits allows a brownfield developer to use resources normally spent to pay taxes for other purposes.

Means a full or partial exemption from City of Fort Worth ad valorem taxes on eligible real and personal property located in a NEZ for a specified period on. Chapter 100 Tax Abatement. Through these incentives the.

January 26 2018 1 min read. Information about Form 843 Claim for Refund and Request for Abatement including recent updates related forms and instructions on how to file. Tax Abatement means the reduction of the amount of property taxes required to be paid on taxable property for a set period of time usually up to 10 years in order to incentivize.

Define Abatement or Tax Abatement. Reasons that qualify for relief due to reasonable cause depend on the type of penalty you owe and the laws in the Internal Revenue Code IRC for each penalty.

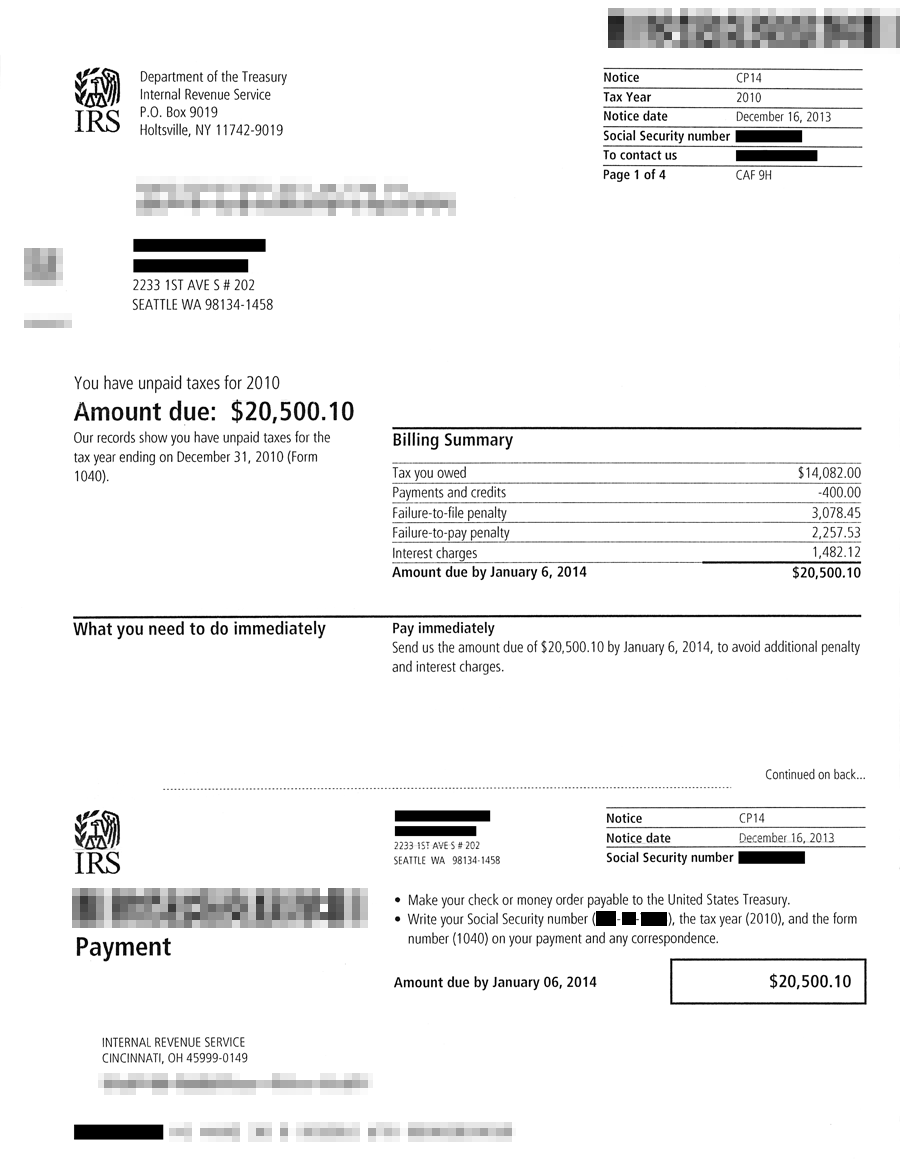

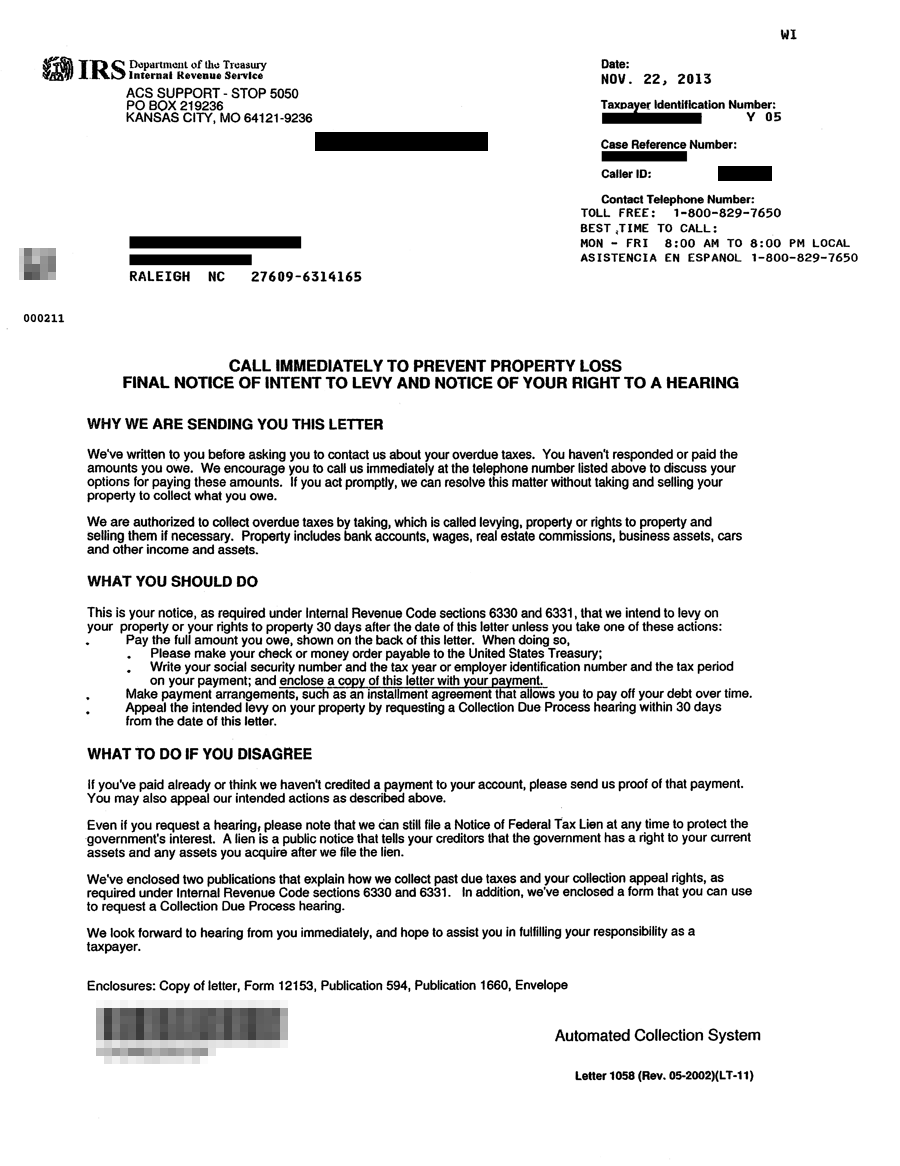

Tax Letters Washington Tax Services

3 11 13 Employment Tax Returns Internal Revenue Service

A Canadian Guide To Filing And Paying Corporate Tax Bench Accounting

Tax Letters Washington Tax Services

3 11 13 Employment Tax Returns Internal Revenue Service

Irs Penalty For Late Filing H R Block

Tax Letters Washington Tax Services

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Tax Letters Washington Tax Services

3 11 13 Employment Tax Returns Internal Revenue Service

3 11 13 Employment Tax Returns Internal Revenue Service

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

:max_bytes(150000):strip_icc()/GettyImages-649719504-62b7bc84aa6c47a7ba6c985cd65a8e4e.jpg)

:max_bytes(150000):strip_icc()/GettyImages-904286032-4cc94e81854841989b260d5df5ae98d6.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1301491715-e74fda1402e6477a9477bff256370b83.jpg)

/TaxBreak-8df76aa21741494d9655ca7c81bc7e34.jpg)