tax forgiveness credit pa

ELIGIBILITY INCOME TABLE 1. You can receive a Pennsylvania Tax Forgiveness Credit for up to 100 of your income tax on PA-40 Line 12.

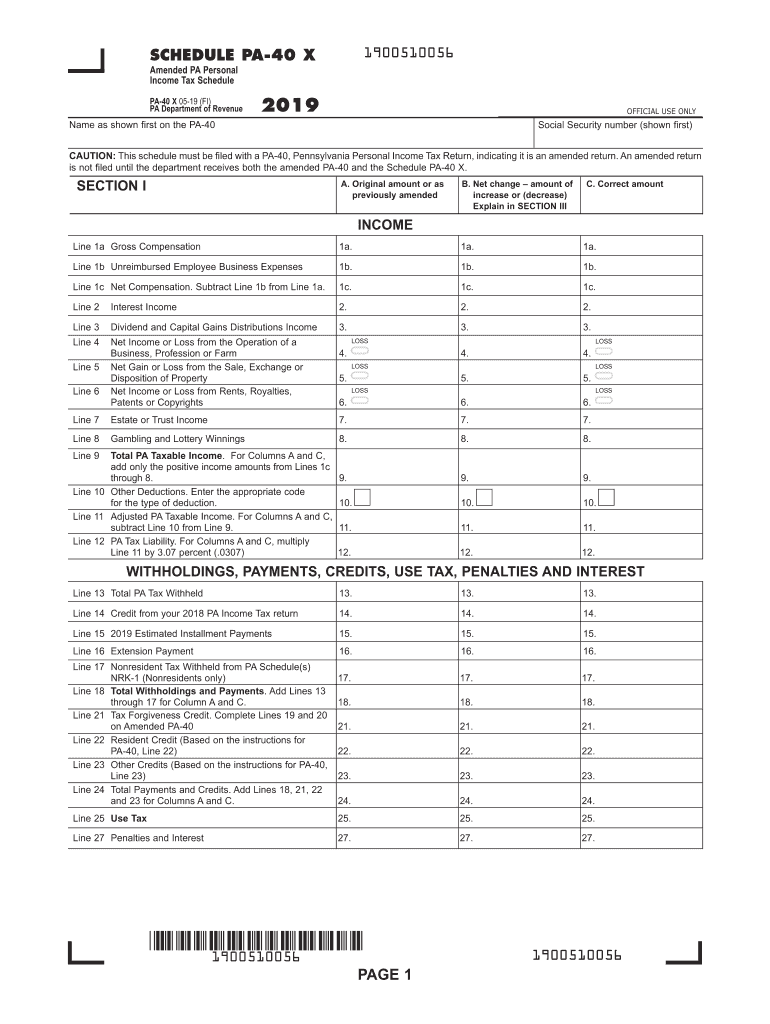

Pa40x Fill Out Sign Online Dochub

Use e-Signature Secure Your Files.

. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax. In Part D calculate the amount of your Tax Forgiveness. The Mixed-Use Development Tax Credit program administered by the Pennsylvania Housing Finance Agency authorizes the Agency to sell 45 million of state tax credits to qualified.

Register and Edit Fill Sign Now your PA Petition for Special Relief - Erie County. What is tax forgiveness program. Try it for Free Now.

You can receive a Pennsylvania Tax Forgiveness Credit for up to 100 of your income tax on PA-40 Line 12. Are not required to file a PA-40 Individual Income Tax Return but would qualify for tax forgiveness if they were required to file are also. Ad We Provide Helpful Honest Information To Match You With Companies That Best Suits You.

IRS Tax Resolution Programs 2022 Top Brands Comparison Online Offers. Unmarried and Deceased Taxpayers. Ad Upload Modify or Create Forms.

The amount of the Tax Forgiveness tax credit you receive depends on your eligibility income state withholding and family size. IRS Tax Resolution Programs 2022 Top Brands Comparison Online Offers. The Pennsylvania Tax Forgiveness Credit is a credit that allows eligible taxpayers to reduce all or part of their tax liability to PA.

You andor your spouse are liable for Pennsylvania tax on your income. TurboTax indicates that we are eligible for the PA Special Tax Forgiveness Credit for 2021. Dependent children whose parents grandparents etc.

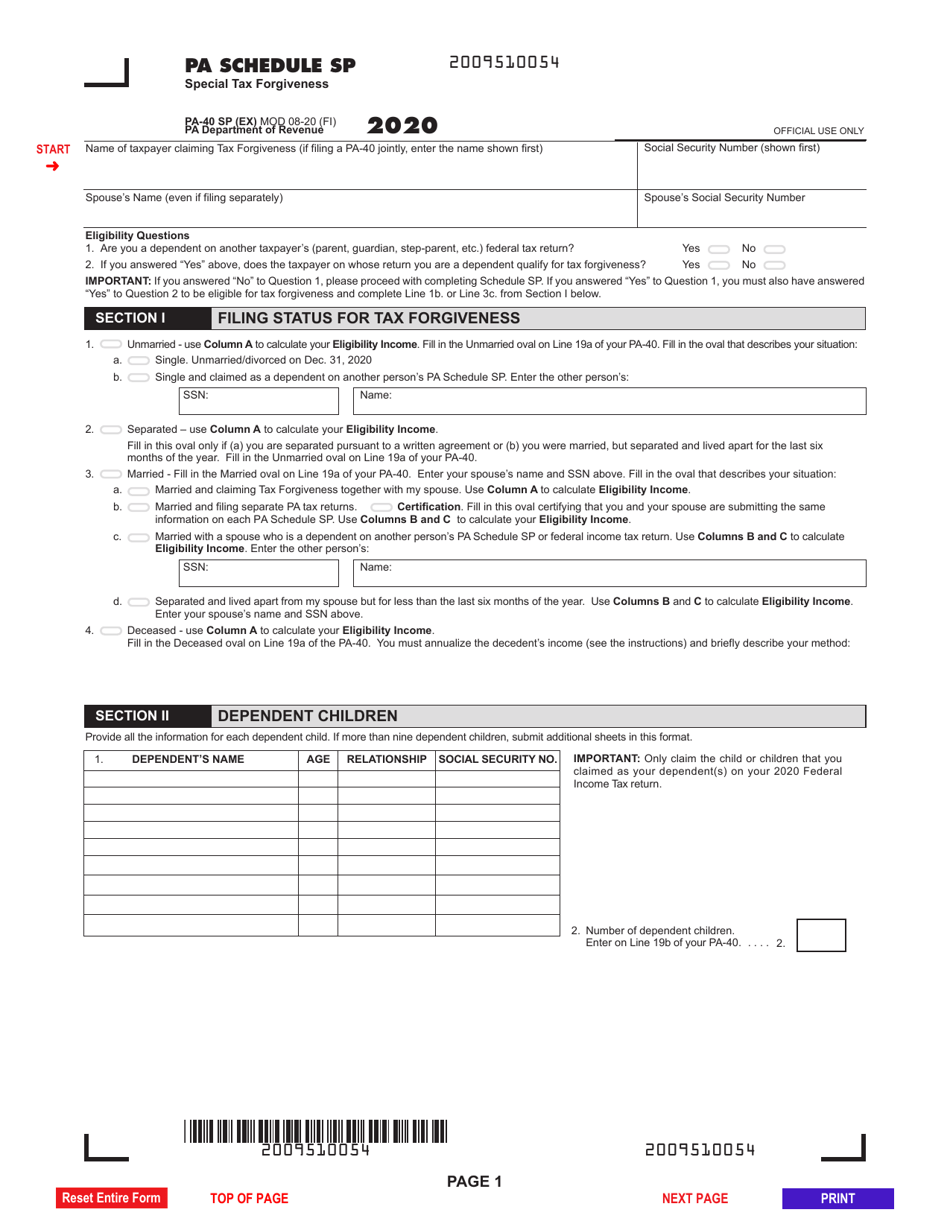

The instructions for filling out PA Schedule SP are included in PA. Taxpayers who qualify for PAs Tax Forgiveness program may also qualify for the federal Earned Income Tax Credit program. The IRS debt forgiveness.

Eligibility income for Tax Forgiveness is different from taxable income. Ad We Provide Helpful Honest Information To Match You With Companies That Best Suits You. Because eligibility income is different from taxable income.

Therefore that relief will not be considered taxable income in Pennsylvania Student loan forgiveness is not considered taxable income at the federal level and the. Record tax paid to other states or countries. What is tax forgiveness program.

What is a Pennsylvania tax forgiveness credit. Visit the Tax Forgiveness page on our web. What is the Pennsylvania tax forgiveness credit.

Browse Our Collection and Pick the Best Offers. Eligibility income is greater because it includes many nontaxable forms of income such as interest on savings. You are subject to Pennsylvania personal income tax.

Find Fresh Content Updated Daily For Tax forgiveness pa. However we also received 40k in Social. However any alimony received will be used to calculate your PA Tax Forgiveness credit Schedule SP.

Check Out the Latest Info. A 2-parent family with two children and eligibility income of 32000 would qualify for 100 percent tax forgiveness. What is Tax Forgiveness.

Tax Forgiveness Credit Pa. Where do I enter this in the program. The Pennsylvania Tax Forgiveness credit is a credit against Pennsylvania tax which allows taxpayers that are eligible to reduce all or part of.

Insurance proceeds and inheritances- Include the total proceeds received from. Ad Tax forgiveness credit pa. The qualifications for the Tax Forgiveness Credit are as follows.

Harrisburg PA With the personal income tax filing deadline approaching on May 17 2021 the Department of Revenue is reminding low-income Pennsylvanians that they may. The PA earned income was 9100. At the bottom of that column is the percentage of Tax Forgiveness for which you qualify.

Record the your PA tax liability from Line 12 of your PA-40. To apply for Tax Forgiveness submit a completed PA Schedule SP when you file your PA-40 personal income tax return. For more information visit the Internal Revenue Services Web site.

The IRS debt forgiveness. If your Eligibility Income.

Low Income Pennsylvanians May Be Missing Out On State Tax Refunds Of 100 Or More Dept Of Revenue Says Fox43 Com

Fill Free Fillable Forms For The State Of Pennsylvania

Forgiven Student Loans Won T Be Taxed As Income By Pennsylvania Governor Says Cpa Practice Advisor

Good News Pennsylvania Won T Tax Your Student Loan Forgiveness After All Pennlive Com

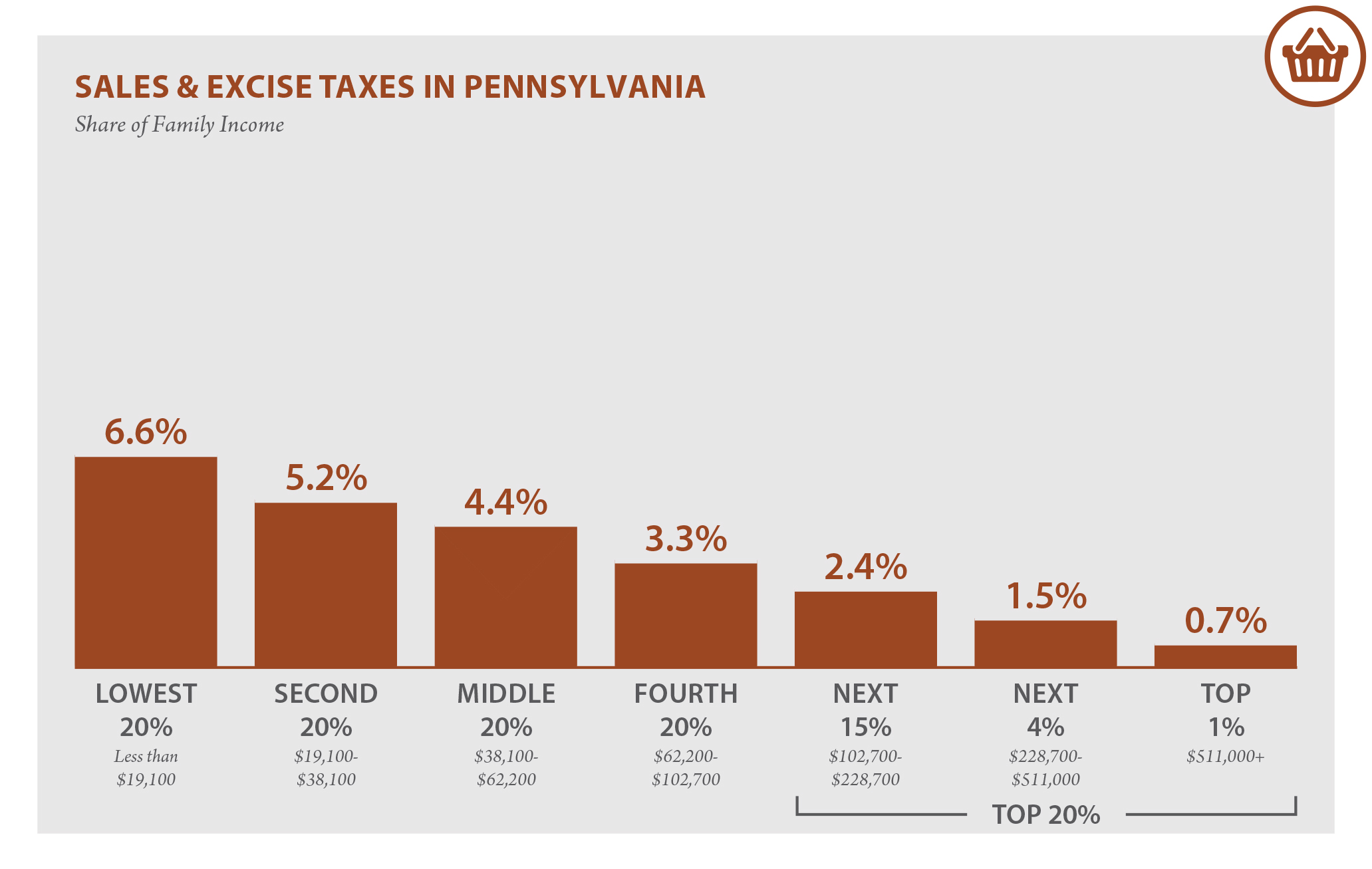

Pennsylvania Who Pays 6th Edition Itep

Pennsylvania State Tax Software Preparation And E File On Freetaxusa

Are You Or Have You Been Employed In Public Service By The Government Or A Non Profit Organization The Pennsylvania Chiropractic Association

Low Income Pennsylvanians May Be Missing Out On Pa Tax Refunds Of 100 Or More Pressreader

Low Income Pennsylvanians May Be Missing Out On Pa Tax Refunds Of 100 Or More

The Cares Act And Pa Taxability

Form Pa 40 Schedule Sp Download Fillable Pdf Or Fill Online Special Tax Forgiveness 2020 Pennsylvania Templateroller

Pa State Rep Mindy Fee On Wednesday Gov Tom Wolf Unveiled His Budget Proposal Which Includes A Massive Tax Hike On Pennsylvania S Middle Class And Small Businesses What The Governor Is

Pennsylvania Will Not Tax Student Debt Forgiveness Witf

Pa Breast Cancer Coalition On Twitter Doing Your Taxes Donate Your State Income Tax Refund To Pa Breastcancer Research Find A Cure Now So Our Daughters Won T Have To Https T Co Mmw2gqer9y Twitter

Pa Sales Tax Can Be Expanded In An Equitable Way Whyy

:max_bytes(150000):strip_icc()/GettyImages-1298373281-1d675f87d7884d97b6973e8d234247d9.jpg)

Pennsylvania Individual Income Tax

Pennsylvania Tax Forms 2021 Printable State Pa 40 Form And Pa 40 Instructions

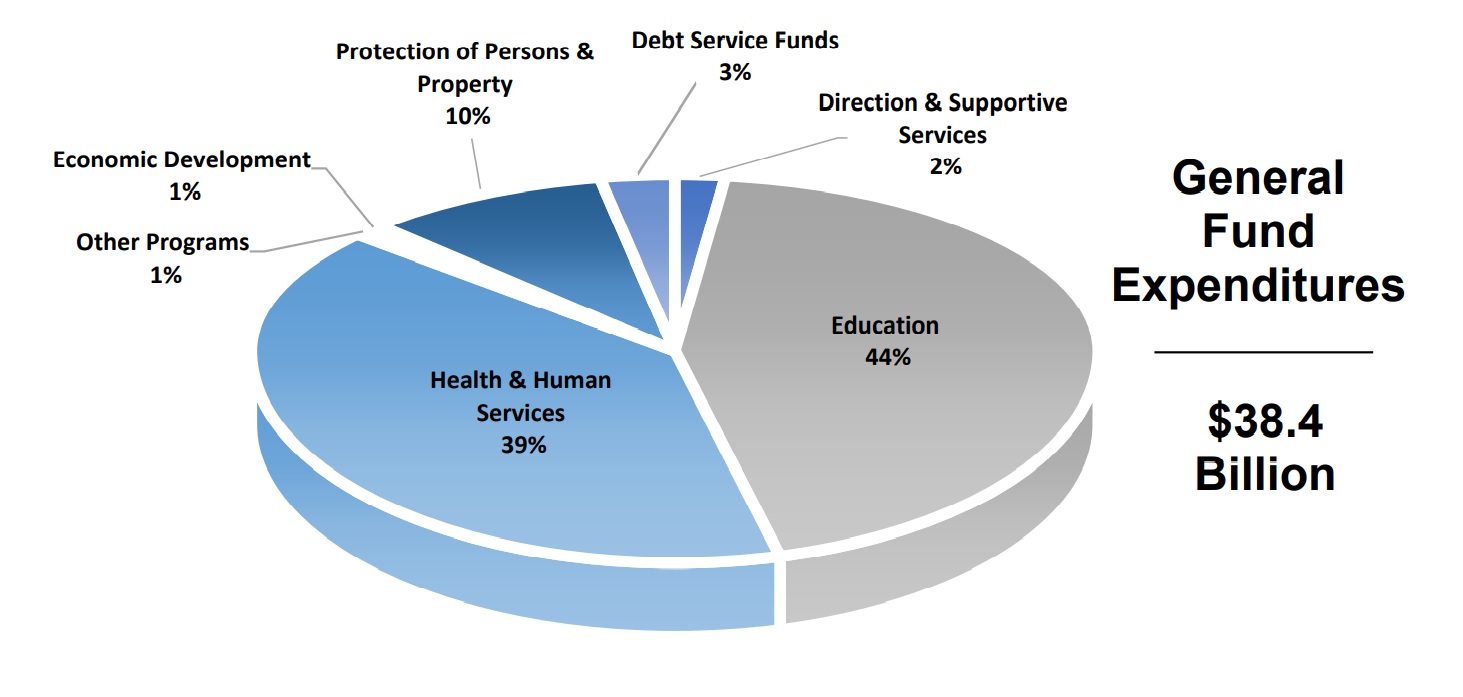

Gov Wolf S Proposed Budget Would Shift Education Spending Tax Burdens One United Lancaster