vt dept of taxes forms

31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. 184 rows This booklet includes forms and instructions for.

Fact Sheets and Guides.

. Vermont State Income Tax Forms for Tax Year 2021 Jan. Review Comes With No Obligation. The Vermont Department of Taxes publishes a report after each legislative session that outlines how legislation impacts taxpayers.

Find the Vermont Department Of Taxes Form you require. FIT-167 2020 Instructions 2020 VT Credit for Tax Paid to Other State or Canadian Province. Article 20 of the US-China income tax.

Ad Download or Email VT S-3M More Fillable Forms Register and Subscribe Now. Trusted Reliable Experts. C-104 Vermont Internet Tax.

Estimated tax payments must be sent to the. C-102 Employers Amended Quarterly Report Form. Department of Taxes.

B-2 Notice of Change. Taxes for Individuals File and pay taxes online and find required forms. 10231X Form W-9 Rev.

8-2013 Vermont Dept of Forests Parks Rec. Vermont has a state income tax that ranges between 335 and 875 which is administered by the Vermont Department of Taxes. Please include your full name company name if.

For more information on 1099-G tax forms visit the Departments website for frequently asked questions information on programs and benefit codes how unemployment. The 1099-G is a tax form for certain government payments. All Forms and Instructions.

IN-111 IN-112 IN-113 IN-116 HS. Vermont Department of Taxes. Use myVTax the departments online portal to e-file and submit Form PTT-172 Property Transfer Tax Return with the Department of Taxes and the municipality with a.

Advance Directive Forms. Form IN-114 - Estimated Income Tax. Send this form and your Advance Directive to the Vermont Advance Directive Registry to store it electronically so hospitals or other providers.

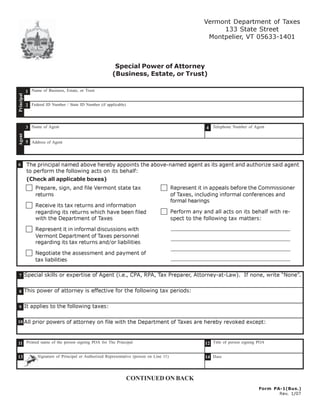

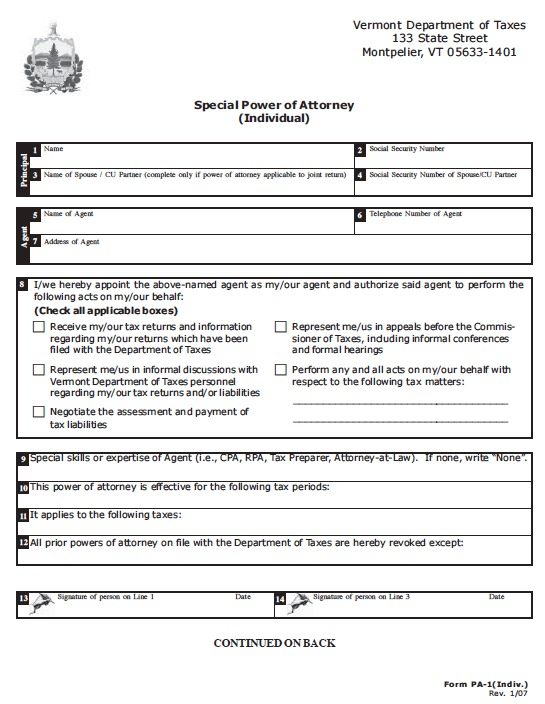

B-2 Notice of Change. PA-1 Special Power of Attorney. Fill the blank areas.

W-4VT Employees Withholding Allowance Certificate. One National Life Drive Davis 2 Montpelier VT 05620-3801. C-147 Employer Quarterly Wage Report Insturctions.

IN-111 Vermont Income Tax Return. Download or Email VT S-3M More Fillable Forms Register and Subscribe Now. Open it using the cloud-based editor and begin editing.

IN-111 Vermont Income Tax Return. FIT-166 2020 Instructions 2020 VT Income Adjustments and Tax Computation for Fiduciaries. W-4VT Employees Withholding Allowance Certificate.

Vermont has a state income tax that ranges between 3350 and 8750. Ad Settle IRS State Tax Problems. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding.

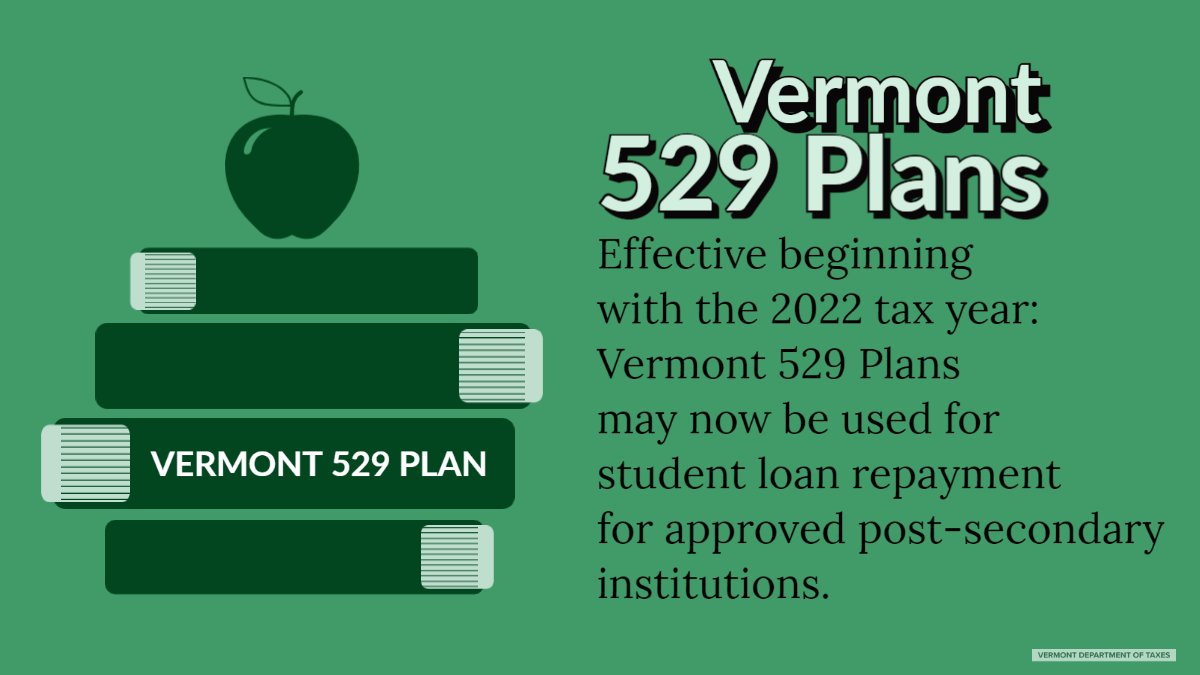

Details on how to only. Get Your Free Tax Review. Read the 2022 legislative highlights to find out whats.

PA-1 Special Power of Attorney. Every January the Vermont Department of Labor sends 1099-G forms to individuals who received unemployment. Register or Renew a Vehicle Find all of the resources you need to register and renew your vehicle in Vermont.

Affordable A BBB Rated Tax Attorney Help. Please mail your written request to. Ad Download Or Email Form HS-122 More Fillable Forms Register and Subscribe Now.

TaxFormFinder provides printable PDF. Engaged parties names places of residence and phone.

Rp 1231 Vermont Department Of Taxes Organizational Chart Department Of Taxes

Vt Dept Of Taxes Vtdepttaxes Twitter

E 1 Estate Tax Return For Deaths Occurring Jan 1 2002 Through Dec

Vt Dept Of Taxes Vtdepttaxes Twitter

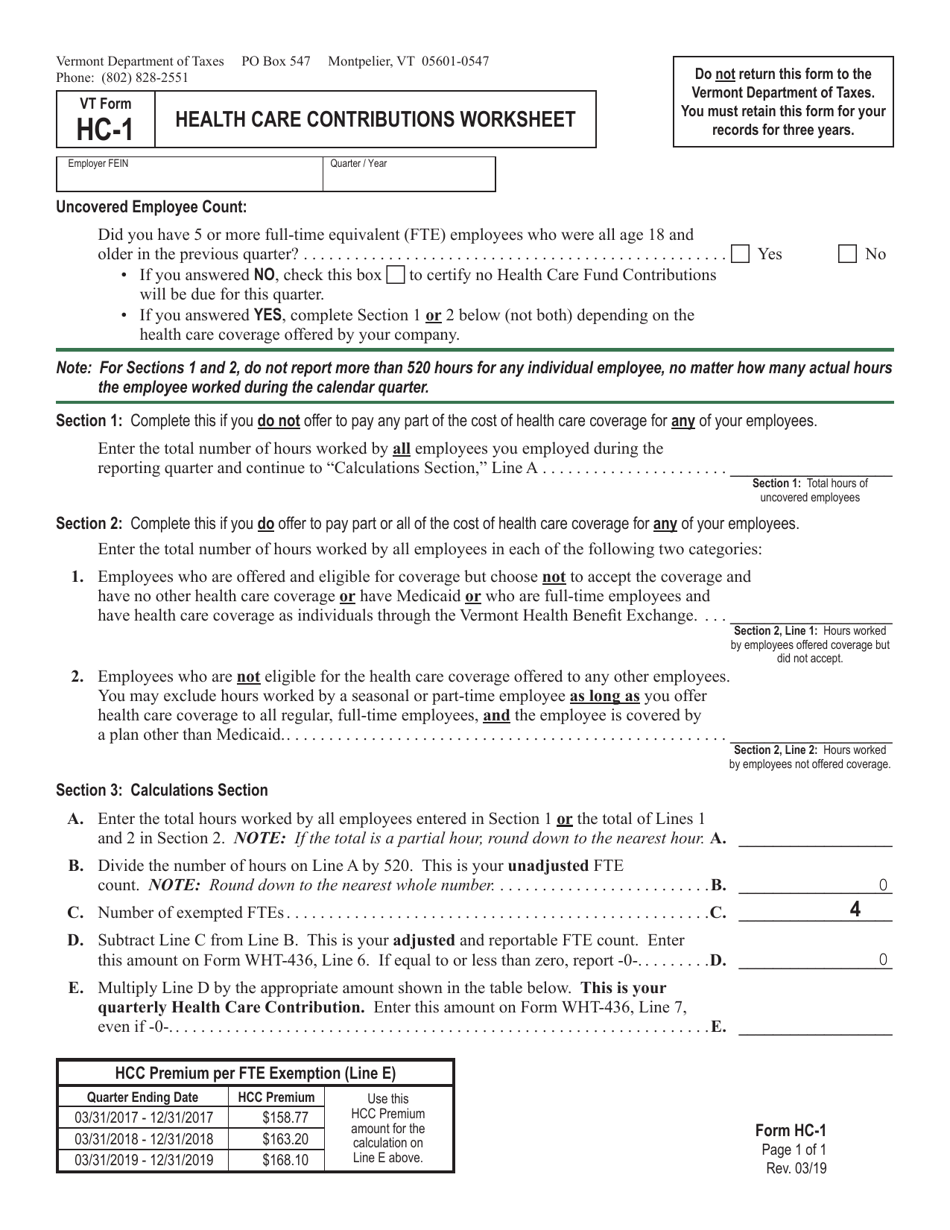

Vt Form Hc 1 Download Fillable Pdf Or Fill Online Health Care Contributions Worksheet Vermont Templateroller

How To Get A Certificate Of Exemption In Vermont Startingyourbusiness Com

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Publications Department Of Taxes

Free Tax Power Of Attorney Vermont Form Pa 1 Pdf

Tax Day 2022 Why This Year Will Be On April 18th Marca

Vermont Tax Forms And Instructions For 2021 Form In 111

Submit Form 15g Or 15h To Avoid Tax Deducted At Source Tax Deducted At Source Save Yourself Investing